How does the online world verify who we are?

It's a bit like trying to prove you're you but without a face-to-face interaction or a physical ID. Let’s say you’re going to a local store and buying something. It's pretty straightforward. You pick your item, hand over cash or swipe your card, and off you go with your purchase.

Now, in the online world, things aren't quite as simple. How do digital platforms know it's you making the purchase when you’re not physically there? And how can you trust that the online store is legitimate?

That's where Verifiable Credentials come into play and digital signatures are an essential part of these credentials. Digital signatures act as the virtual equivalent of your signature on a physical document. They are cryptographic stamps of authenticity that are unique to you and can be used to vouch for the integrity of the information being shared online.

In this article, we’ll go over:

- The role of Verifiable Credentials to prove claims about yourself

- What digital signatures are, how they work, and use case examples

- The difference between electronic signatures and digital signatures

- Dock’s digital signing system

Overview of Verifiable Credentials

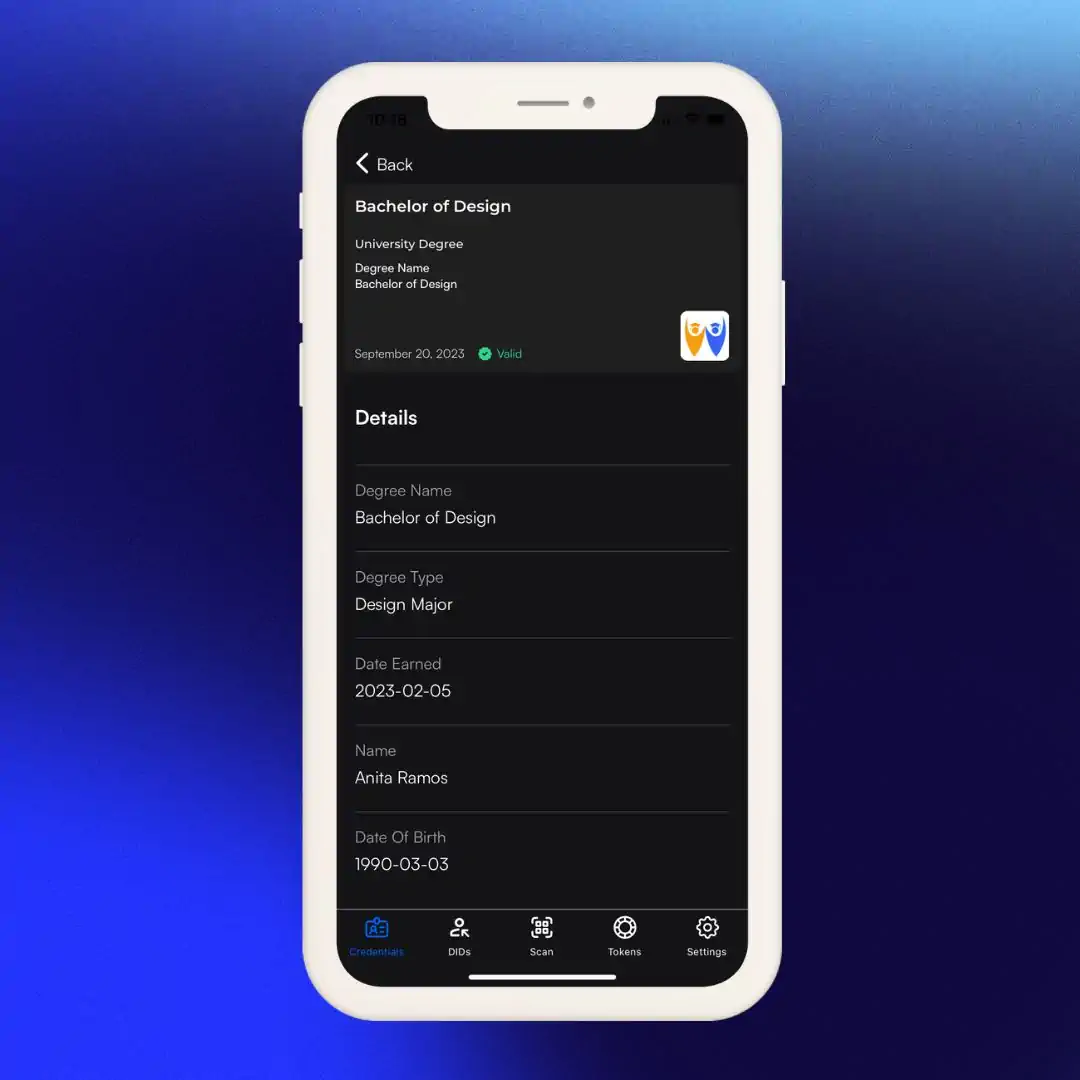

Verifiable Credentials are like digital ID cards that prove claims about yourself in a way that’s secure and can’t be faked. For example, you could have a driver’s license, university degree, or professional license issued as Verifiable Credentials that you could hold in your digital wallet app.

Within these Verifiable Credentials are digital signatures, which confirm that the information on a credential is accurate. A digital signature system is a process for creating a unique, secure stamp on a digital document, much like how we sign a physical document to prove that it comes from us.

We’ll explain in simple terms what each of these are and the differences.

Verifiable Credential System

In a Verifiable Credential system there are three main parties:

1) The Issuer: This is the trusted entity or organization that creates and provides the Verifiable Credential. An issuer can be the state issuing your driving license or a university issuing your degree certificate.

2) The Holder: The person who owns and controls the Verifiable Credential. Just like you keep your driving license in your wallet, you would store your Verifiable Credential in a secure digital wallet on your phone.

3) The Verifier: This is the entity or individual that needs to check the credential. For example, the bar that wants to check if you're old enough to drink could be the verifier of the digital credential that proves your age.

Together, these three roles create a system that allows us to prove important information about ourselves online.

What Is a Digital Signature and How Does It Work?

A digital signature is like a unique digital stamp that proves a credential's authenticity and shows that it hasn't been tampered with.

Think about how we often sign physical documents to verify their authenticity and confirm our agreement with their contents. Whether you’re signing a receipt, a contract, or an agreement, your signature shows that it's genuinely from you and that you stand by the information given.

To apply this concept in the context of Verifiable Credentials, digital signatures play a crucial role in making sure these online ID cards are legitimate and trustworthy. Digital signatures are the backbone of trust in the online world because each signature is like a digital fingerprint unique to each user, making our online interactions secure and reliable.

How Does a Digital Signature Work?

A digital signature is created by using a secret key that only the issuer knows, making it hard for anyone else to reproduce it. When a verifier (like an online service or website) checks your Verifiable Credential, they can examine this digital “stamp.” They can use it to confirm that the credential indeed came from the trusted issuer and that none of the details have been changed or tampered with after the issuer provided it.

Let’s use this analogy for the digital world:

Special Seal = Private Key: In the digital world, we can use something called a "private key" which is a secret digital code that only you have. This key is made up of a string of letters and numbers.

Stamping the Letter = Signing with the Private Key: When you want to send a digital message (or credential) and prove that it's genuinely from you, you "stamp" it using your private key. This process is called "signing".

Recognizing the Seal = Public Key: For others to verify that your message is authentic, they use something called a "public key" (which corresponds to your private key but isn’t secret). If they can "read" the stamp on the message using your public key, then they know the message is genuinely from you as only someone who knows both the public and private key can sign the message. A public key is also made up of a string of letters and numbers like this: 1A2B3C4D5E6F7G8H9I0J1K2L3M4N5O6P7Q8R9S0T1U2V3W4X5Y6Z.

Digital Signature Use Case Examples

Digital signatures play a vital role in enhancing security and trust in a variety of sectors:

Education

1) Universities can issue digital versions of diplomas and transcripts, signed with their unique digital signature. When a graduate applies for a job and presents their digital diploma, the employer can verify its authenticity by checking the digital signature against the university's public key without having to contact the issuer at all.

2) When a student completes an online exam, their answers can be combined into a document that is digitally signed by the student's unique identifier. This ensures that the answers submitted by the student haven't been altered after submission and verifies that they came from the specific student.

Finance

1) When making a large bank transfer, the transaction can be digitally signed by the bank or the user. This ensures that the details (like the amount and recipient) haven't been altered in transit.

2) In cryptocurrency systems like Ethereum, smart contracts are executed with the assurance of digital signatures, ensuring the initiator of the contract is genuine.

Healthcare

1) Doctors can digitally sign e-prescriptions, ensuring the medicine and dosage are exactly as prescribed. Pharmacies can then verify the signature to confirm that the prescription is genuine and hasn't been altered.

2) When transferring patient records between departments or hospitals, records can be digitally signed to ensure data integrity and authenticity.

Identity Verification

1) Digital versions of passports and IDs can carry a digital signature from the issuing authority (like a government). When a person presents their digital ID for verification (e.g. at an airport or online service), the verifier can check the digital signature to ensure it's a genuine ID.

2) When logging into online services, a user's authentication request can be digitally signed, providing an added layer of security to ensure the user is who they say they are.

Digital Signature in Blockchain

When discussing blockchain, we often hear terms like "decentralization," "immutable ledger," and "smart contracts." However, a foundational aspect of blockchain technology that is frequently unnoticed is the role of digital signatures. In blockchain, every transaction, be it a cryptocurrency transfer or the execution of a smart contract, carries a digital signature.

Why Are Digital Signatures Vital for Blockchain?

Ensuring Authenticity

In a decentralized system like blockchain, where there's no central authority to trust, how can participants be sure that a transaction is legitimate?

Before any transaction is added to the blockchain, network nodes validate the digital signature associated with that transaction. If it’s valid, it signifies that the transaction is genuine and initiated by the rightful owner of the associated private key.

Undeniability

Once a transaction is digitally signed and added to the blockchain, the signer cannot deny having signed it. This certainty ensures accountability and trustworthiness in the system.

Securing Private Information

Digital signatures in blockchain use cryptographic keys: a public key, which everyone can see, and a private key, kept secret by its owner. When a transaction is initiated, it's the private key that's used to create the digital signature. For verification purposes, only the public key is needed, ensuring that the signer's private information remains confidential.

What Is the Difference Between an Electronic Signature and Digital Signature?

In the digital age, terms like "electronic signature" and "digital signature" often get used interchangeably. While both have the common purpose of replacing the traditional handwritten signature, they differ significantly in terms of technology, purpose, and security.

Electronic signatures are versatile and user-friendly but may not offer the heightened security and assurance of a digital signature. On the other hand, digital signatures, with their cryptographic underpinning, are ideal for situations that need strong evidence of the signer's identity and the document's integrity.

Let's break down the differences to better understand each of these signatures.

Electronic Signature

An electronic signature, often referred to as e-signature, is a broad category that includes any electronic data (like a scanned image of a handwritten signature, a typed name, or a simple click on a "I Agree" button) that signifies an intention to agree or approve the contents of a digital document.

Key Features of E-signatures

- E-signatures are usually easy to create and can be as basic as typing your name into a digital form.

- They can take many forms including a simple tick box, a drawn image on a touch screen, and more complex forms like biometric authentication.

- They represent a person's intent to agree to the contents of a document, similar to how a handwritten signature expresses agreement on paper.

Digital Signature

A digital signature is a specific type of e-signature that provides higher security and trust. It uses cryptographic techniques to generate a code (the signature) that is unique to both the signer and the content. This ensures not only the signer's identity but also verifies that the document hasn't been tampered with after signing.

Key Features of Digital Signatures

- Digital signatures rely on Public Key Infrastructure (PKI) to generate a paired set of cryptographic keys: a public key that anyone can see and a private key that is kept secret by the signer.

- When a document is digitally signed, the signature validates the signer's identity.

- A digital signature ensures that the document wasn't altered after signing. If someone tries to change the document, the signature will become invalid.

What Is a Digital Signature Scheme?

An easier way to understand “digital signature scheme” is to think of it as a digital signing system.

Imagine a special, invisible ink that only you have. When you write a letter with this ink, you also use a little of it to create a unique mark (like a personal stamp) at the end of your letter. This mark helps people know that the letter truly came from you and that no one changed its content after you wrote it.

A "digital signature scheme" is like the method or set of rules for using this special ink. It helps people create their unique marks on digital documents so others can trust that the document is genuine and hasn't been tampered with.

Dock’s Digital Signature Schemes

Dock’s supports several digital signing systems including PS, BBS, and BBS+ for both issuers and verifiers for these specific tools:

Each of these signature schemes has its unique strengths and the best choice depends on the issuer's specific needs and circumstances. Our expert developers guide customers on which scheme is best to use for their use cases.

Conclusion

As the world accelerates its shift towards digitization, the importance of trust and authenticity in our online interactions can’t be overstated. Digital signatures play a crucial role in securing our digital documents and transactions. They provide not only an assurance of the signer's identity, but also vouch for the integrity of the content while ensuring it remains untampered.

Whether you're a business that needs to validate digital contracts or an individual ensuring the security of personal communications, embracing digital signing methods will play a key role in navigating the digital world with confidence and security.

About Dock

Dock’s Verifiable Credential platform makes any data fraud-proof and instantly verifiable. It comprises the Certs API, the Certs no-code web app, an ID wallet and a dedicated blockchain. Using Dock, organizations reduce data verification costs while increasing the operational efficiency of verifying and issuing digital credentials. Individuals can fully control their data to access products and services more conveniently in a privacy-preserving way. Dock has been a leader in decentralized digital identity technology since 2017 and trusted by organizations in diverse sectors, including healthcare, finance, and education.

Partner Use Cases

- SEVENmile issues fraud-proof verifiable certificates using Dock

- BurstIQ Makes Health Data Verifiable, Secure, and Portable With Dock

- Gravity eliminates Health & Safety certificate fraud with Dock

Learn More

- How to Prevent Certificate Fraud

- How to Prevent Supply Chain Fraud With Blockchain

- BurstIQ Use Cases That Leverage Verifiable Credentials

- Blockchain Food Traceability: Enhancing Transparency and Safety

- What Are Digital Credentials?

- Data Compliance

- Web3 Identity

- Blockchain Identity Management

- Selective Disclosure